Jan 15, 2026

Top Accounting Features Every Growing Business Needs

As your business grows, managing finances becomes more complex. Spreadsheets and manual systems that once worked for a small team often can’t keep up with the increased workload. That’s where modern accounting software comes in.

A smart, automated accounting system helps you stay organized, save time and make better financial decisions. In this blog, we’ll look at the top accounting features every growing business should have to stay efficient, compliant and competitive.

1. Real-Time Financial Tracking

Always Know Where Your Money Is Going

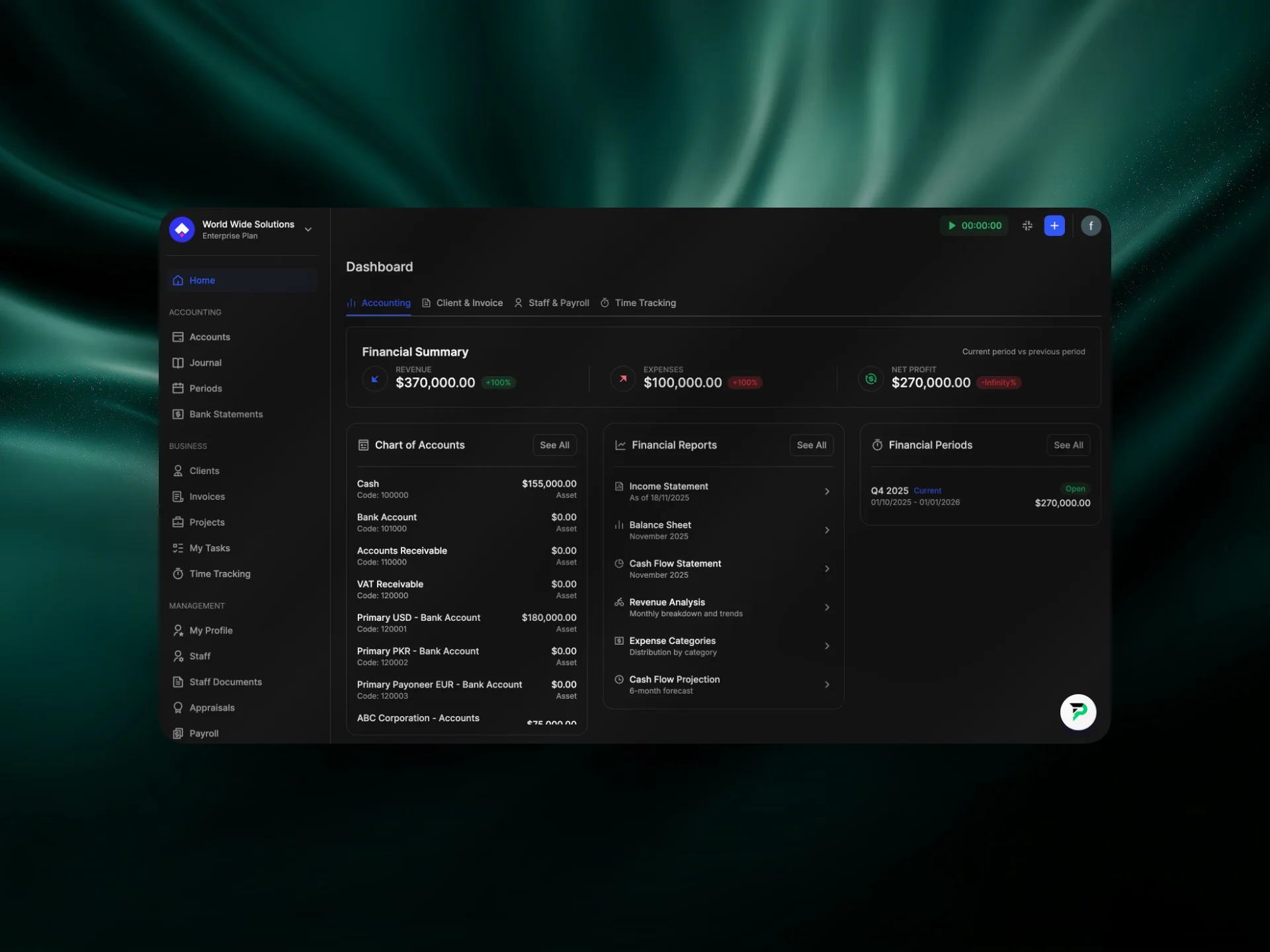

In a growing business, cash flow visibility is everything. Real-time financial tracking allows you to see exactly where your money is going and how much is coming at any moment.

Instead of waiting for monthly reports, modern tools instantly update transactions, balances and expenses. This gives business owners more control and helps them make faster, data-based decisions that improve profitability.

2. Automated Invoicing and Payments

Save Time and Avoid Missed Payments

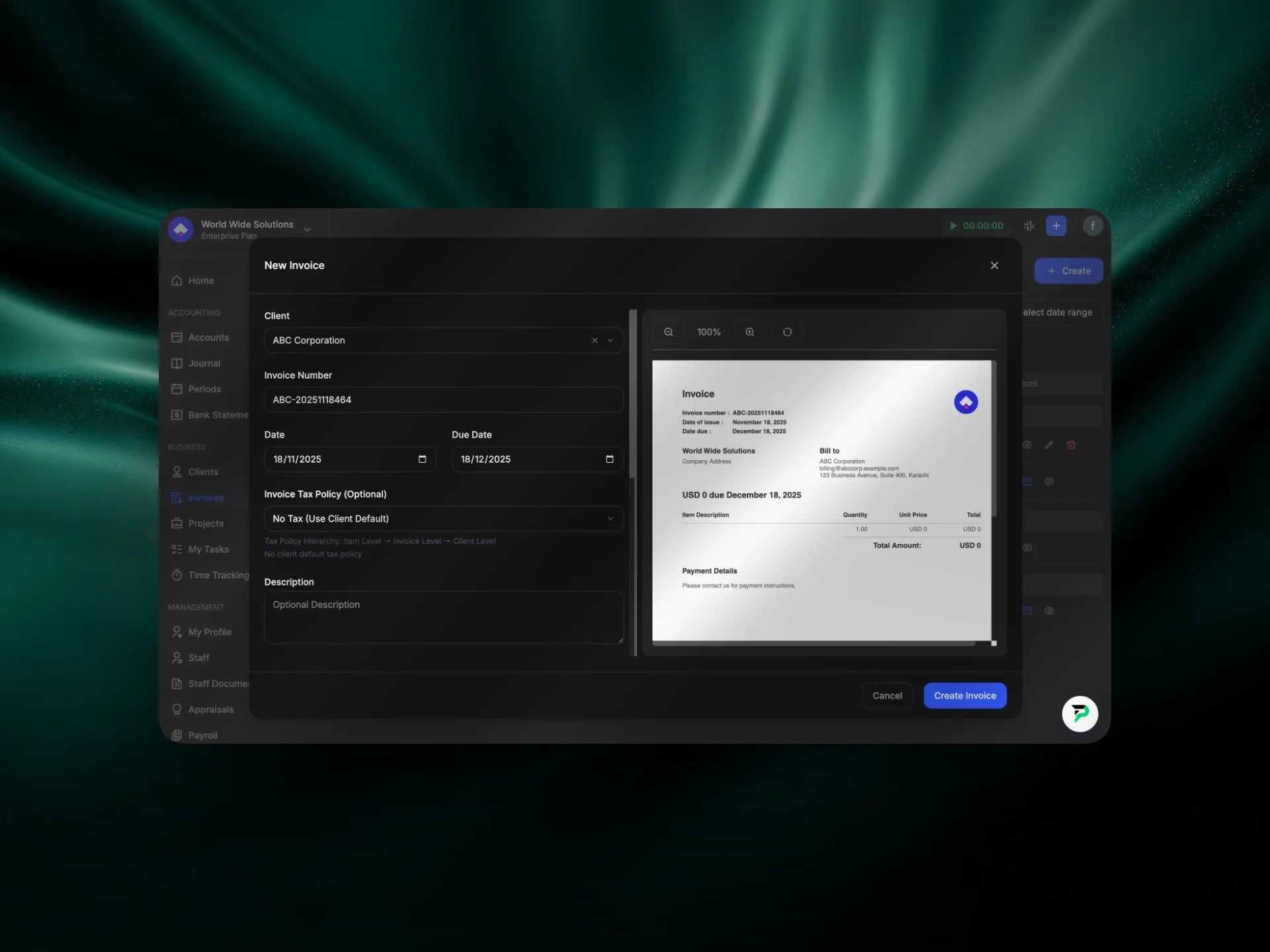

Manually creating and sending invoices can be tiring and error-prone. With automation, you can generate professional invoices instantly, track due dates and even send reminders automatically.

The Top business accounting software ensures that every payment is recorded and you’re always on top of who owes you and when. This keeps your cash flow steady and reduces late or missed payments that often slow down business growth.

3. Expense Management and Budget Control

Keep Spending in Check

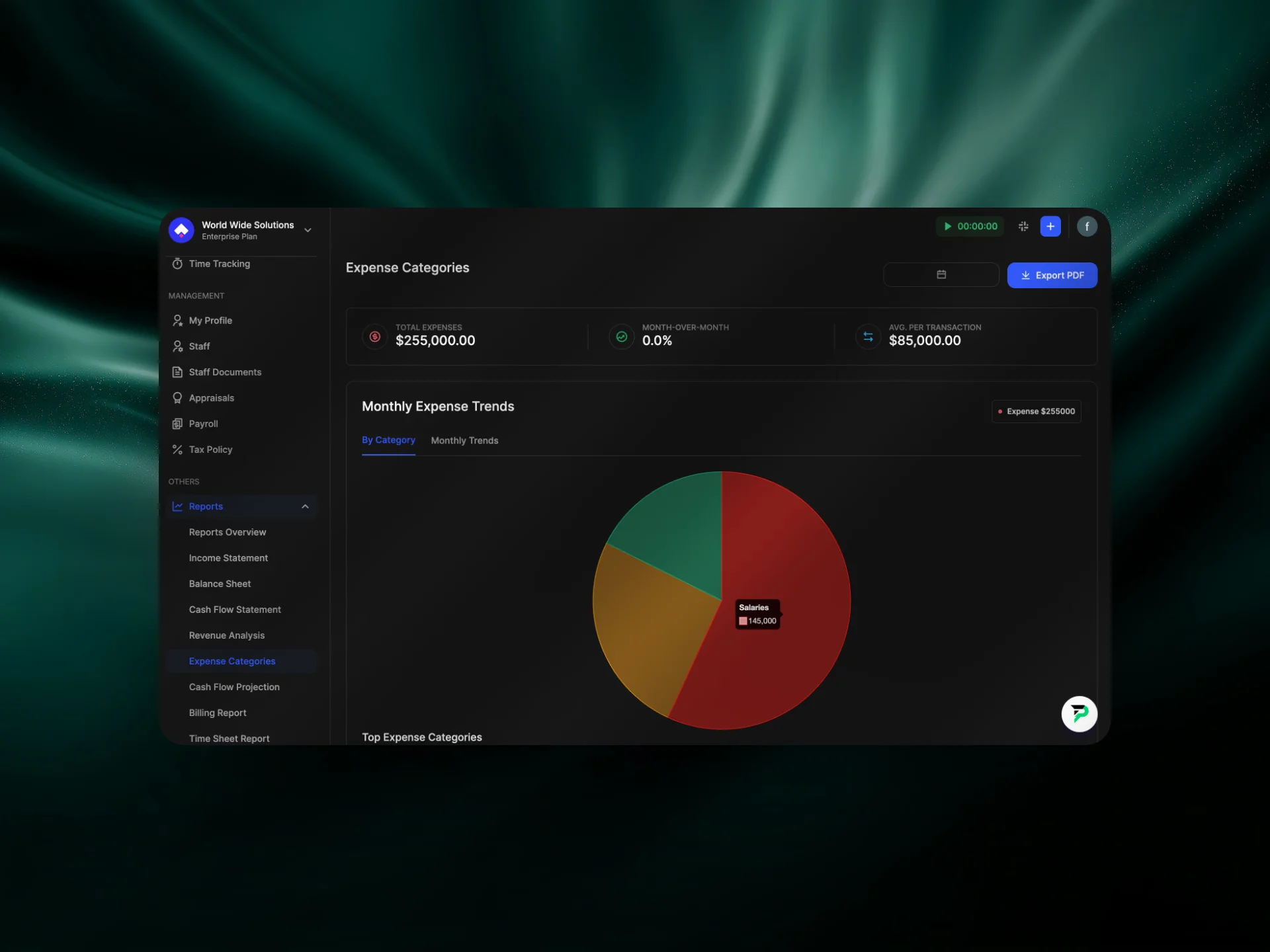

As your company expands, it’s easy for small expenses to slip through the cracks. A built-in expense tracking system helps categorize costs, flag unusual spending and compare actual expenses against planned budgets.

With detailed reports, you can see exactly where money is being used whether it’s salaries, operations, or marketing. This makes it easier to plan future budgets and cut unnecessary costs without affecting performance.

4. Payroll and Tax Management

Simplify Salaries and Compliance

Payroll can be stressful, especially when dealing with multiple employees, varying salaries and taxes. Automation removes the headache by calculating salaries, deductions and tax policies automatically.

An All-in-One Accounting Solution allows you to handle payroll, bonuses, appraisals and compliance in one place. This saves time, reduces manual errors and keeps your financial records always audit-ready.

5. Customizable Reports and Insights

Make Data-Driven Decisions

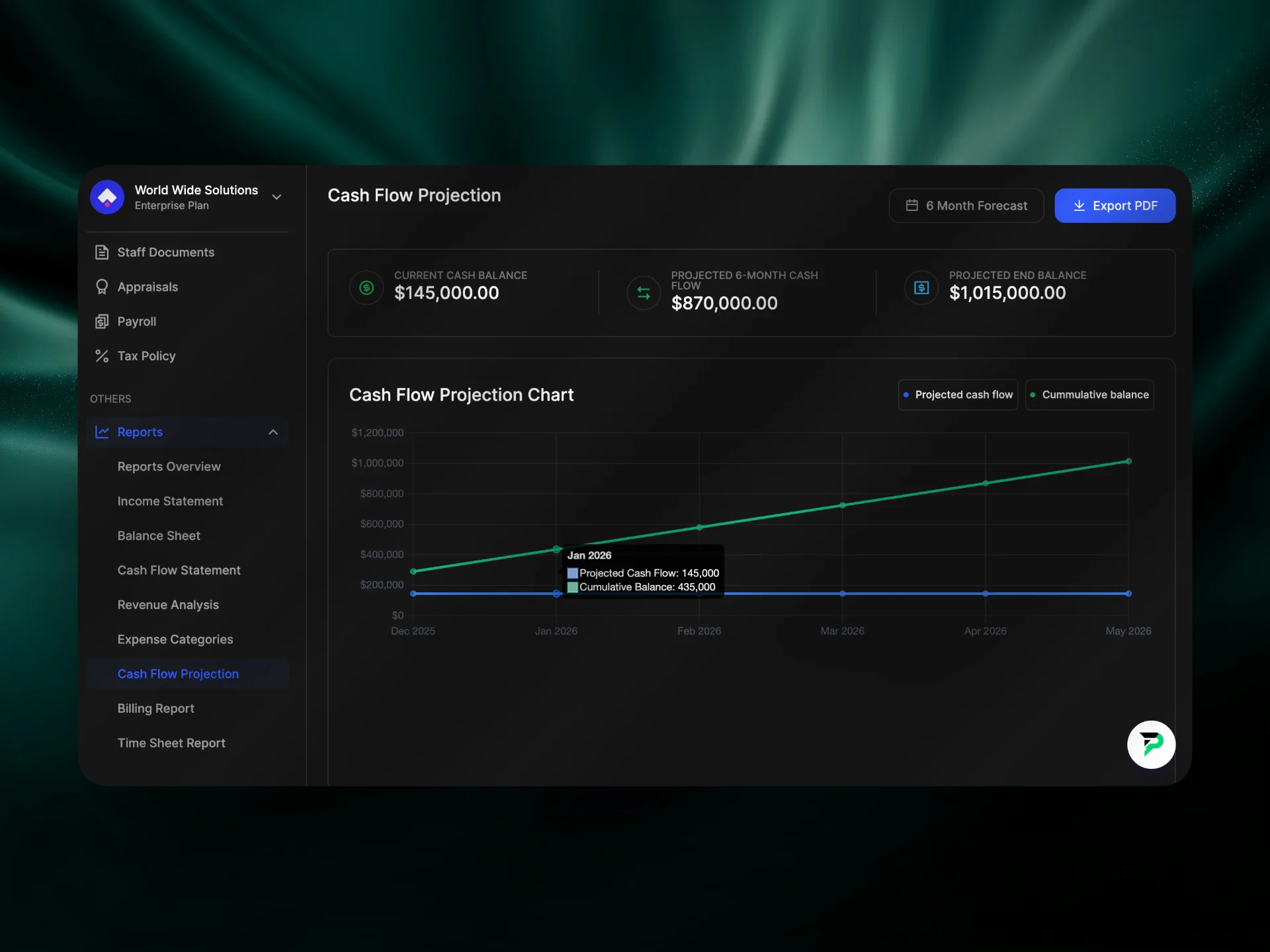

Every successful business depends on accurate and timely insights. When you have access to detailed, customizable reports, you can clearly see how your business is performing from every angle. These reports help you analyze profit margins, spending patterns, sales performance and department-wise results all in one place.

Instead of spending hours compiling spreadsheets, you can generate visual reports with just a few clicks. Built-in dashboards provide an at-a-glance view of your company’s health, showing what’s working well and what needs improvement. You can easily identify cash flow issues, track overdue payments, or measure which departments are driving the most growth.

With this level of visibility, your decisions become faster and more accurate. You’re no longer relying on assumptions, you're using real-time financial data to plan budgets, control expenses and set achievable business goals.

6. Secure Cloud Storage and Multi-User Access

Work From Anywhere, Safely

In today’s business environment, flexibility is key. Teams often work remotely or across different locations and having instant access to financial information is crucial. Cloud-based accounting systems make this possible by securely storing all your data online and syncing it in real time. You and your team can access your accounts anytime, anywhere, without needing to exchange files or rely on a single device.

Security is another major benefit. Advanced encryption and backup features protect sensitive financial data from unauthorized access or accidental loss. With role-based access control, you can assign specific permissions so accountants, managers and team leads can each view only what’s relevant to their role.

This not only improves data security but also encourages better teamwork. Everyone stays aligned, updates are visible instantly and there’s no risk of version errors or duplicate entries. Cloud accounting turns financial management into a smooth, collaborative process that fits modern work environments perfectly.

Conclusion

Modern accounting isn’t just about recording numbers it’s about building a system that supports growth, accuracy and collaboration. Having features like real-time tracking, automation, secure cloud storage and insightful reporting gives your business the edge it needs to move forward confidently.

When your accounting platform handles tasks smoothly, your team can focus on strategy instead of paperwork. Choosing the right software means you’re investing in both efficiency and long-term success.

If you’re ready to upgrade your financial management with a system designed for growing businesses, explore Halal Accounts, your trusted partner for smarter, faster and more efficient accounting.