Jan 19, 2026

How to Simplify Payroll Processing Without Errors

1. Understand the Payroll Basics

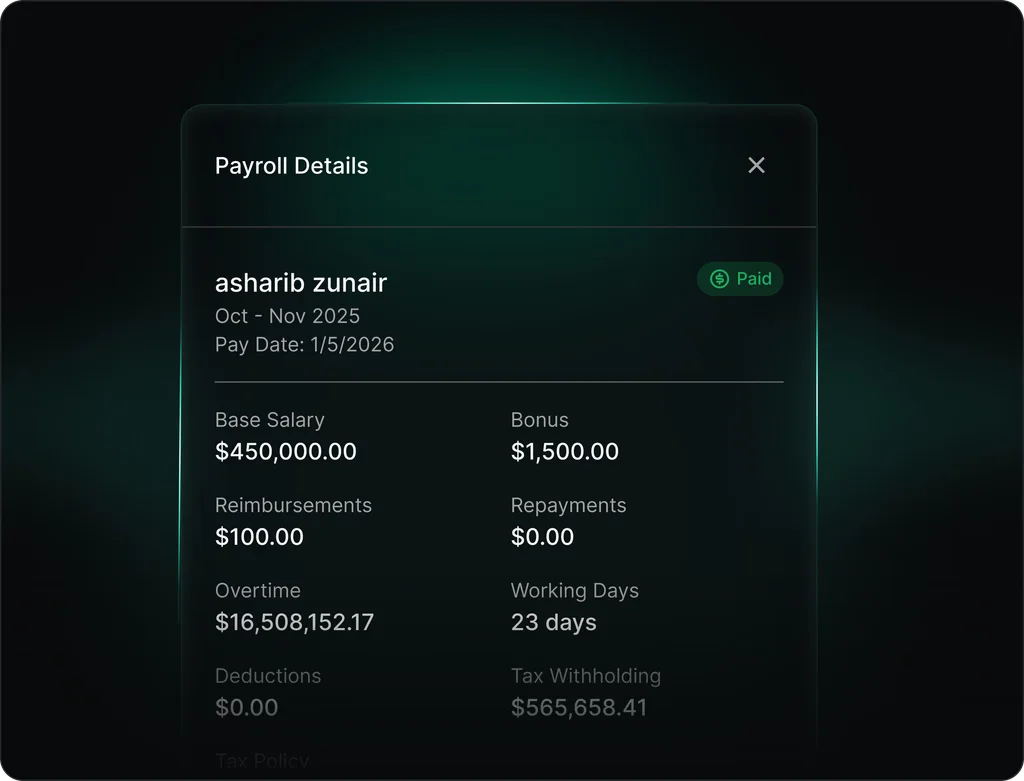

Payroll management isn’t just about paying employees it’s about accuracy, consistency and compliance. Before simplifying the process, you need to understand the essential components: basic salaries, deductions, benefits and taxes. Many companies face payroll errors because they overlook specific deductions like insurance contributions, income tax, or overtime adjustments. By breaking down each payroll element, you gain complete visibility into how funds are distributed and ensure nothing gets missed. This foundational understanding helps you spot issues early and maintain smoother, more transparent financial management.

Know What Affects Payroll Accuracy

Payroll errors usually come from unclear policies or incomplete employee data. For example, late updates on attendance or miscommunication about bonuses can throw off calculations. Setting clear payroll policies and maintaining accurate staff information prevents confusion at the end of each pay cycle. When your HR and accounting teams follow the same structure, payroll runs become faster and more reliable. The more clarity you build into your process, the easier it is to ensure every employee gets paid the right amount at the right time.

2. Centralize Your Payroll Data

Managing payroll across multiple spreadsheets or systems often leads to version control issues and miscalculations. By centralizing all payroll data in one secure platform, you bring consistency and clarity to the process. Having everything from employee profiles to tax details in one place eliminates manual cross-checking and human error. A unified system also helps managers access real-time financial data whenever needed, creating a smoother flow of information between HR, accounting and leadership teams. Centralized data means fewer mistakes and better decision-making.

Use Technology to Simplify Operations

This is where an All-in-One Accounting Solution truly makes a difference. It automates salary calculations, generates reports instantly and provides a single dashboard for all payroll activities. By reducing the need for manual input, you save time and lower the risk of costly errors. Automated tools also make compliance easier by keeping track of tax updates and reminders. Whether you’re managing five employees or fifty, using an integrated payroll system streamlines the process and ensures accuracy every time you process payments.

3. Automate Salary Calculations

Payroll automation takes away the stress of manual calculations and the risk of human errors. Instead of spending hours entering numbers and double-checking totals, automation allows the system to handle tasks like tax deductions, overtime and bonuses automatically. This not only ensures accuracy but also speeds up the process significantly. Businesses can rely on automation to maintain uniform salary structures across departments, leaving less room for confusion. The result is a faster, more consistent payroll system that keeps both employees and employers confident in every payout.

Use Accounting Tools for Seamless Processing

Using Top business accounting software can completely transform how you handle payroll. These tools come with pre-set templates for salaries, deductions and allowances, making it easier to process bulk payments without delays. Integration with HR systems means attendance data, time tracking and bonuses update automatically no manual imports required. With automation, you not only save time but also ensure your team gets paid accurately, every time. It’s an efficient, stress-free way to manage payroll while reducing administrative workload and improving employee satisfaction.

4. Maintain Compliance and Records

Every business has legal responsibilities when it comes to payroll. Keeping up with labor laws, tax policies and filing deadlines can be overwhelming, especially when done manually. That’s where technology becomes essential. Modern accounting systems simplify compliance by storing digital copies of payroll slips, tax filings and employee payment histories in one secure location. Having everything organized and easily accessible means you’ll never lose critical records or miss important submission dates. It’s a smart way to ensure transparency and accountability in your financial operations.

Stay Ahead with Automated Compliance

Compliance isn’t just about following rules it’s about protecting your business from risks. With automated accounting systems, you get real-time alerts for due tax filings, payroll cutoffs and regulation changes. These tools make it easy to stay compliant without extra stress. Instead of worrying about penalties or audits, you can focus on managing your team and growing your business. By combining automation with consistent recordkeeping, your payroll system becomes both efficient and legally sound a win-win for long-term business success.

5. Improve Team Coordination

Payroll isn’t only about numbers; it’s also about communication. Misalignment between HR and accounting teams can easily cause payment delays or wrong entries.

With integrated software, every team member can access accurate payroll data anytime. This improves coordination, keeps everyone updated and ensures smooth month-end processing.

Conclusion

Simplifying payroll processing is about building smarter systems not working harder. By automating salary calculations, centralizing data and ensuring compliance, you can eliminate most payroll errors for good. If you’re ready to experience a seamless, stress-free payroll system, explore Halal Accounts trusted partner for reliable, accurate and modern accounting management.