Feb 6, 2026

How Halal Accounts Simplifies All-in-One Accounting

Managing business finances shouldn’t feel overwhelming — yet for many small business owners and accountants, it often does. Multiple tools, scattered data, manual reconciliations, and constant switching between platforms can slow everything down and increase the risk of errors.

This is exactly where an all-in-one approach to accounting makes a difference. In this post, we’ll break down the real problems businesses face with traditional accounting setups, how modern solutions solve them, why ethical and compliant accounting matters, and how choosing the top business accounting software can simplify everything under one roof.

The Problem: Accounting Tools That Don’t Work Together

Most small businesses don’t start with complex systems. They add tools as they grow — invoicing software here, payroll somewhere else, spreadsheets for reporting, and maybe another tool for expenses.

Over time, this creates problems like:

Financial data is spread across multiple platforms

Manual data entry and duplicated work

Inconsistent reports and numbers that don’t match

More time spent managing tools than running the business

For accountants, this fragmentation becomes even more painful when managing multiple clients. Switching logins, exporting data, and fixing errors eats into time that could be spent on analysis and strategy.

What businesses really need is clarity, simplicity, and control — not more tools.

The Solution: One System That Handles Everything

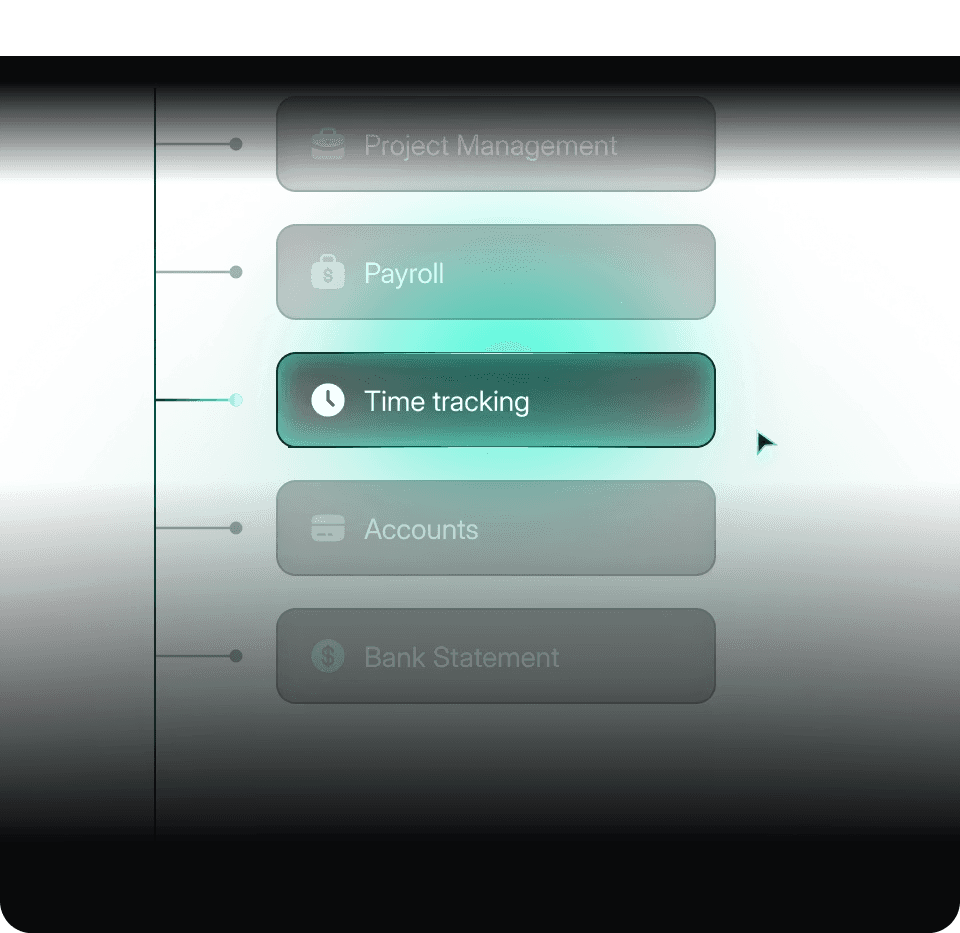

All-in-one accounting software Halal Accounts removes the complexity by bringing core financial tasks into a single platform. Instead of juggling systems, businesses can manage:

Invoicing and payments

Expenses and cash flow

Payroll and taxes

Financial reporting and insights

When everything lives in one place, data stays consistent, workflows are smoother, and decisions are made faster. This is why more businesses are moving away from patchwork solutions and choosing unified accounting platforms.

For small businesses especially, simplicity is not a “nice to have” — it’s essential.

Why Halal-Focused Accounting Still Matters

Even without diving into religious technicalities, many businesses prefer accounting systems that promote transparency, fairness, and ethical financial practices. This is where halal-focused accounting solutions stand out.

They are designed to support clean financial structures, clear reporting, and compliant money management without unnecessary complexity. For accountants and business owners in many regions, this approach aligns well with modern compliance requirements and responsible business operations.

The result? More confidence in your numbers and no gray areas in your financial records.

How Halal Accounts Bring It All Together

Halal Accounts simplifies accounting by combining essential financial tools into one intuitive system. Instead of forcing businesses to adapt to the software, it’s built to support real-world workflows.

Here’s how it makes a difference:

1. Centralized Financial Management

All key accounting functions are accessible from a single dashboard. This reduces errors, saves time, and gives a clear overview of business performance.

2. Easy for Accountants and Business Owners

The platform is designed so both accountants and non-technical users can navigate it comfortably. This improves collaboration and reduces back-and-forth communication.

3. Clear Reporting and Insights

With real-time reports and clean financial data, staff can track performance, monitor cash flow, and plan with confidence.

4. Scales as the Business Grows

Whether you’re a small startup or managing multiple staff members, the system adapts without adding unnecessary complexity.

When evaluating the top business accounting software, these are exactly the features that separate average tools from solutions that actually support growth.

Choosing the Right Accounting Software for the Long Term

Accounting software isn’t just about managing today’s numbers — it’s about setting your business up for long-term success. A well-designed all-in-one system reduces operational stress, improves accuracy, and gives business owners the clarity they need to make smarter decisions.

Instead of building your accounting stack piece by piece, choosing a unified platform from the start can save time, money, and frustration down the line.

And when that platform is built with simplicity, transparency, and scalability in mind, it becomes more than just software — it becomes a business partner.