Feb 10, 2026

AI Accounting Tools Small Businesses Should Use in 2026

As a small business owner, choosing the right tools can make a huge difference in efficiency and growth. In 2026, AI is transforming financial management, making it easier than ever to handle complex accounting tasks. For businesses looking to streamline operations, reduce errors, and make smarter decisions, investing in the Best Accounting Software is essential.

In this blog, we’ll explore the top AI accounting tools that small businesses should consider, how they integrate with existing workflows, and why combining them with a Performance Management System for Teams can maximize productivity and financial clarity.

Why Small Businesses Need AI-Powered Accounting

Traditional accounting software is often limited in automation and predictive capabilities. Small businesses frequently face:

Manual data entry errors

Delayed financial reporting

Inconsistent expense tracking

Difficulty forecasting cash flow

AI accounting tools address these challenges by automating repetitive tasks, detecting anomalies, and providing real-time insights. This not only saves time but also improves accuracy, allowing business owners to focus on strategy rather than number crunching.

Key Features of AI Accounting Tools in 2026

Modern AI accounting platforms go beyond basic bookkeeping. Some of the most valuable features include:

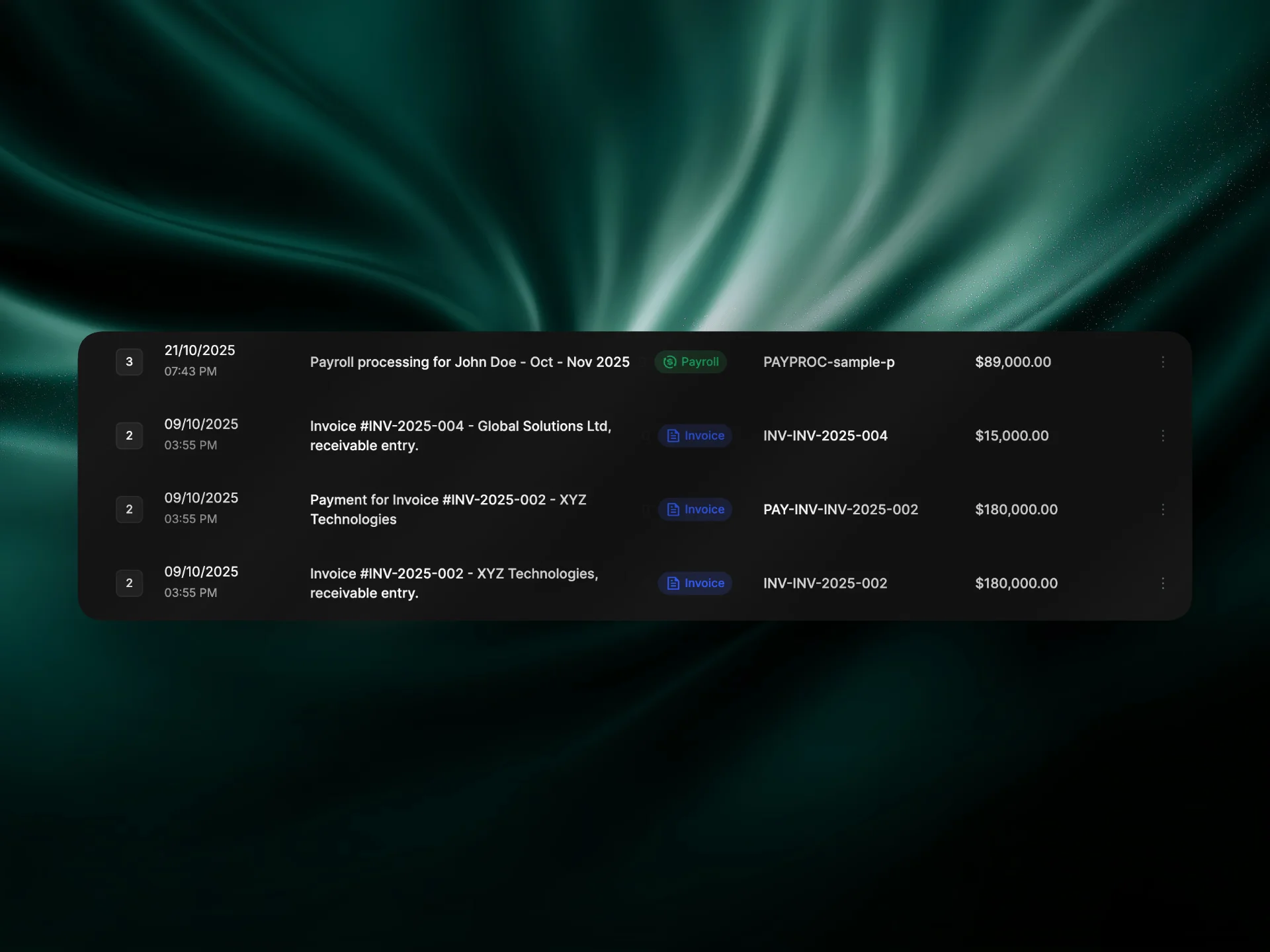

Automated Data Entry: Scans receipts, invoices, and bank statements, reducing human error

Smart Forecasting: Uses AI to predict cash flow trends, helping businesses plan ahead

Expense Management: Categorizes and tracks expenses automatically for easy reporting

Real-Time Reporting: Provides dashboards with KPIs, profit and loss statements, and actionable insights

These features help small businesses make informed decisions quickly, without needing extensive accounting knowledge.

Integrating AI Tools with a Performance Management System for Teams

Combining AI accounting tools with a Performance Management System for Teams allows businesses to link financial performance directly with operational efficiency. Benefits include:

Tracking project costs and team productivity in one platform

Aligning budget allocations with business goals

Identifying bottlenecks and opportunities for optimization

Enabling data-driven performance reviews for finance and operations

This integration ensures that accounting isn’t just about numbers—it becomes a strategic tool that drives growth and team alignment.

Choosing the Right AI Accounting Tool

When selecting AI-powered software, small businesses should consider:

Ease of Use: Minimal learning curve for non-accounting staff

Automation Capabilities: Tasks like invoicing, payroll, and reconciliation should be streamlined

Integration Options: Should work seamlessly with project management, payroll, and reporting tools

Scalability: Must grow with the business as transaction volumes and team sizes increase

Selecting the right software ensures that financial management remains accurate, efficient, and future-proof.

Security and Compliance

AI accounting tools must prioritize data security and compliance. Features to look for include:

Encrypted cloud storage

Regular security audits

Compliance with local tax regulations

User access control and permissions

These measures protect sensitive financial data while keeping businesses audit-ready.

Final Thoughts

Small businesses looking to stay competitive in 2026 should embrace AI accounting tools. From automating routine tasks to providing predictive insights, these platforms transform how companies manage their finances. When paired with a Performance Management System for Teams, businesses gain visibility, efficiency, and strategic control over their operations.

For small businesses seeking a reliable, AI-powered accounting solution, Halal Accounts provides an all-in-one platform that automates accounting tasks, improves accuracy, and helps business owners make smarter financial decisions every day.