Jan 28, 2026

Why Every Small Business Needs an All-in-One Accounting Solution in 2025

Running a small business in today’s fast-changing digital world is both exciting and demanding. Entrepreneurs need to balance sales, expenses, and financial records while keeping operations efficient. Yet, many still rely on outdated spreadsheets and manual bookkeeping systems that drain time and increase the risk of costly errors. That’s why more businesses are switching to All-in-One Accounting Solutions, a smarter way to manage everything from payroll to financial reports in one place.

1. Simplify Daily Financial Tasks

Managing daily transactions manually can be overwhelming, especially when every expense and invoice needs to be recorded separately. An all-in-one accounting platform centralizes these tasks, helping you monitor cash flow, record expenses, and reconcile accounts seamlessly.

By automating repetitive tasks, small businesses can save hours each week and focus on growing their customer base rather than getting buried in paperwork.

2. Gain Real-Time Insights into Business Performance

In 2025, data-driven decision-making is more important than ever. A unified accounting system provides real-time financial dashboards that show where your money is going and how your business is performing. These insights allow business owners to make informed decisions on spending, hiring, and investments without waiting for end-of-month reports.

That’s what makes Halal Accounts one of the Best Accounting Software options for small businesses that want clear financial visibility and smarter control.

3. Reduce Errors with Automation

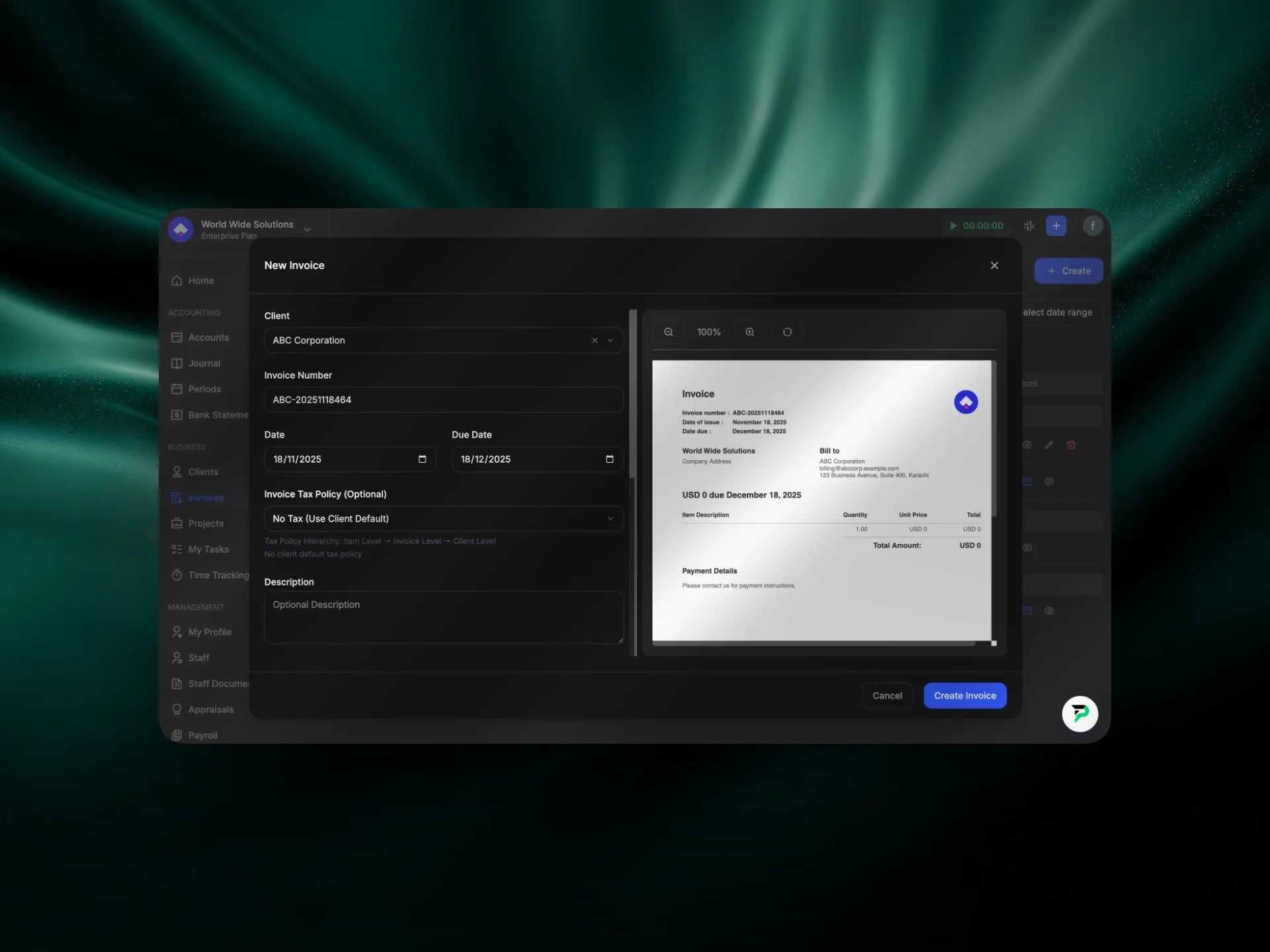

Manual data entry can lead to inconsistencies, especially when managing invoices, taxes, and staff payments across multiple tools. Automation ensures accuracy by syncing all financial records in one system. Whether you’re generating invoices, processing payroll, or tracking tax deductions, an automated solution reduces the chance of human error while maintaining compliance with the latest financial regulations.

4. Scale Easily as Your Business Grows

As a business expands, its financial operations become more complex. All-in-one platforms are built to grow with your company, supporting additional users, departments, and modules without extra hassle. Unlike traditional software, modern accounting tools integrate seamlessly with other systems like payroll, invoicing, and reporting, providing a flexible base that adapts to your growth.

5. Why Choose Custom Accounting Solutions

Every business operates differently from how it manages staff to how it tracks revenue. That’s where custom accounting solutions come in. Tailored systems allow you to personalize dashboards, automate workflows specific to your business type, and integrate third-party tools that fit your needs. Small businesses benefit from the flexibility to modify features without being tied to one-size-fits-all software.

Conclusion

In 2025, small businesses that embrace automation and integration will have a clear advantage over those still managing finances manually. A complete accounting platform like Halal Accounts empowers teams to save time, stay compliant, and make smarter business decisions all from one secure cloud-based system.